The recent fiscal discussions on Capitol Hill have been complex, revolving around terms like "budget reconciliation," "one bill/two bill," and "vote-a-rama." Let's clarify the House and Senate Budget Committees' actions and their implications for the upcoming legislative process.

Congressional Republicans aim to implement President Trump's agenda of tax cuts and reduced federal spending. While their slim House majority presents challenges, the Senate's 53 seats are insufficient to overcome filibusters, requiring 60 votes. This is where "budget reconciliation" comes in—a parliamentary procedure used by both parties to circumvent filibusters and pass legislation.

Democrats utilized budget reconciliation for Obamacare in 2009-2010, while Republicans attempted to repeal it in 2017 and successfully passed Trump's tax cuts later that year using the same process. Crucially, using reconciliation requires a pre-existing budget approved by both chambers.

After weeks of deliberation, House Republicans finally advanced a budget plan through committee. This plan proposes $4.5 trillion in tax cuts, $2 trillion in mandatory spending cuts, and a $4 trillion debt limit increase. It's designed to appeal to conservatives, a crucial factor considering the GOP's internal divisions.

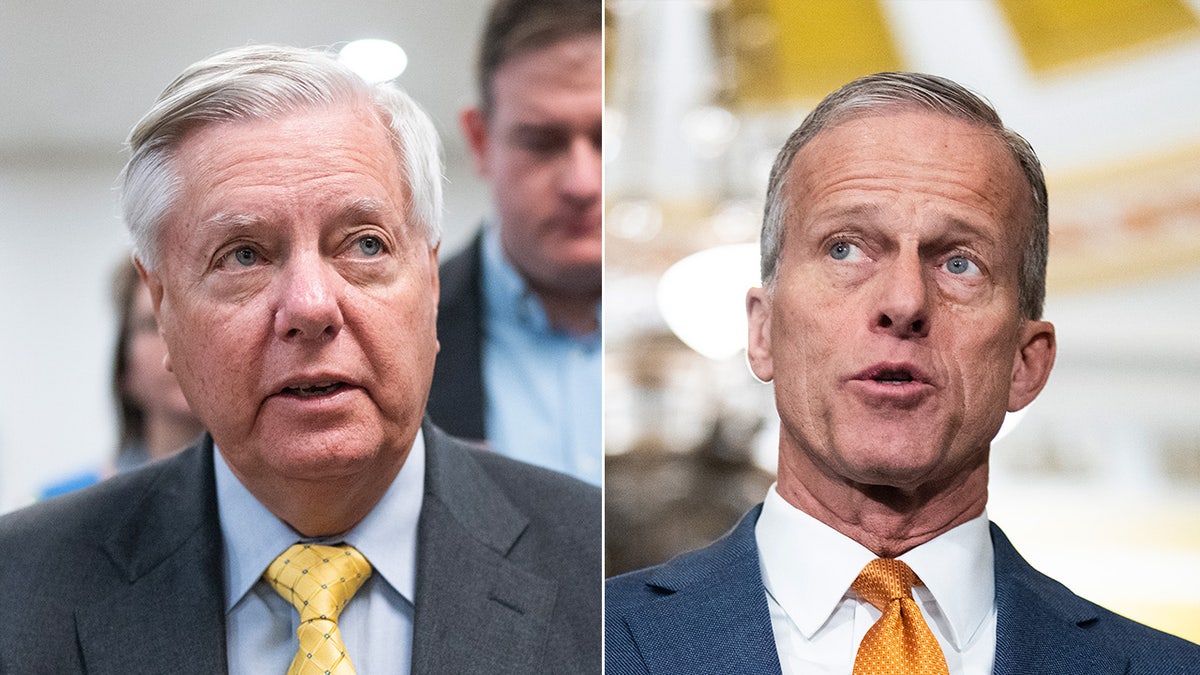

Meanwhile, Senate Republicans pursued a different strategy, prioritizing military spending, border wall funding, and increased energy production. Senator Lindsey Graham argued that border security should take precedence over tax and spending cuts, a key difference in approach from the House.

This divergence led to the "one bill, two bill" debate, with the House favoring a comprehensive bill and the Senate preferring a two-pronged approach. The House's ability to pass even a single bill remains uncertain, potentially allowing the Senate to force its version upon them.

The Senate's 50-hour budget debate concluded with a "vote-a-rama," a series of votes on amendments. This process aims to create a legislative framework for bypassing the filibuster later, provided the proposal is fiscally responsible and doesn't increase the deficit over ten years. However, this framework only serves as a shell, requiring further legislative action on specific provisions.

Gaining support for the House budget proposal, let alone the final bill, poses a significant challenge. Conservatives believe it doesn't cut enough, while moderates worry about the deficit impact of tax cuts. Representatives from high-tax states may oppose it if it doesn't address the state and local tax (SALT) deduction.

One proposed solution involves offsetting tax cuts with tariff revenue, potentially reaching $1 trillion annually. However, this figure seems overly optimistic, and tariffs can't be officially counted towards deficit reduction unless included in the legislation. Including tariffs could alienate some Republicans who view them as a tax on consumers.

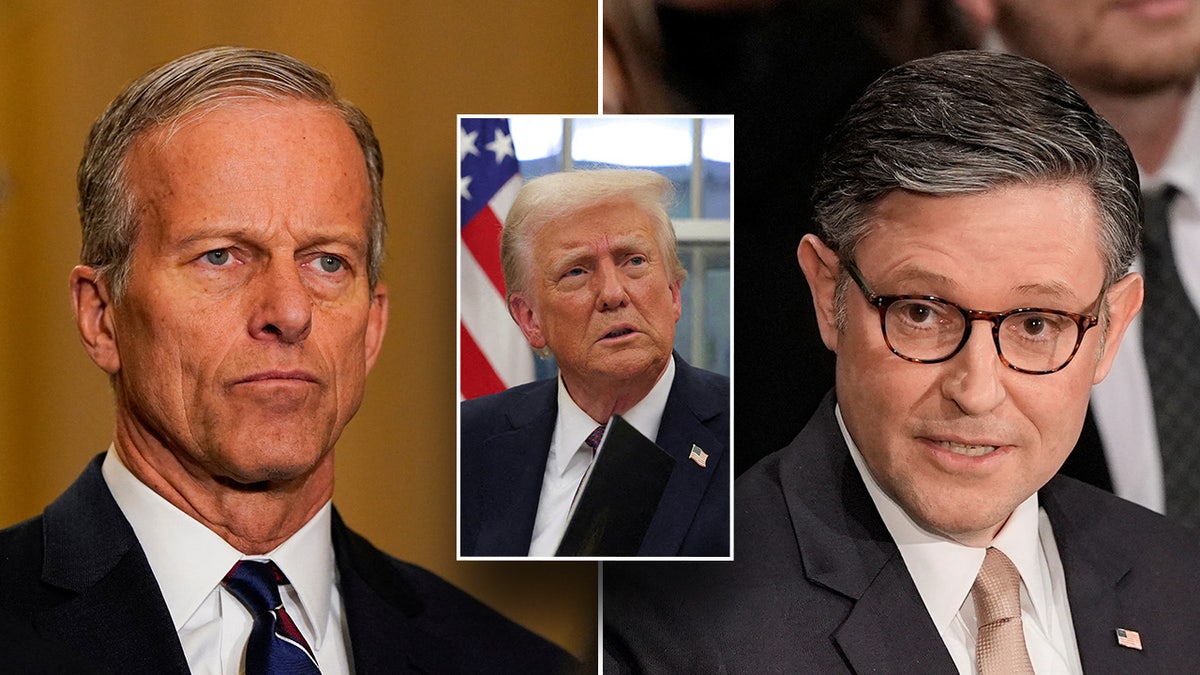

President Trump's endorsement of the House's "one big beautiful bill" further complicated matters, seemingly contradicting the Senate's approach. While Senate Republicans continued with their plan, the president's intervention added another layer of complexity to the already challenging legislative process.

Key questions remain: Will the president's endorsement sway skeptical House Republicans? Can the House pass a plan? Can both chambers agree on a framework to move forward with the actual bill? The answers are uncertain, making the path forward for the president's agenda unclear.

Comments(0)

Top Comments